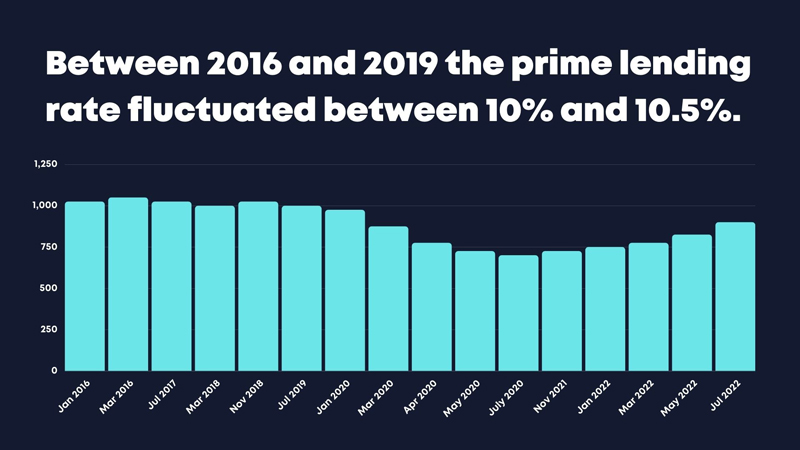

We are all feeling the strain of higher-than-forecast inflation, high food and energy costs, currency depreciation, record load shedding and, inevitably, repo rate hikes as our Monetary Policy Committee (MPC) struggles to curb July’s reported 7.8% inflation levels. So, with the latest in an uninterrupted series of repo rate hikes, 75 bps on 22 September 2022, the biggest hike since 2002, we see the repo rate now at 6.25% and the prime lending rate rising to 9.75%. And, with still one more Monetary Policy Committee (MPC) announcement to go before year-end, market opinion is leaning quite heavily towards the likelihood of the prime interest rate reaching around 10% by then, a return to the 10% to 10.5% “normalised” levels in 2016 to 2019, prior to the onset of the Covid-19 pandemic.

There is some good news at home, however. For the first time in decades, South Africa’s inflation 7.8%; repo rate 6.25%, is lower than that of the US (inflation rate 8.5%; repo rate 2.5%) and the UK (inflation rate 10.1%; repo rate 1.75%).

In terms of property, it’s interesting to see what constitutes real value for money by comparing what a R5 million property looks like in South Africa versus London, Australia, New Zealand, US and Portugal. It is apparent that in spite of our many challenges at home, the grass isn’t always necessarily greener on the other side and South Africa still offers excellent value for money for residential property.

Exhorbitant commissions

On the other hand, I believe that traditional agencies charge exorbitantly high commissions, based on a percentage of the sale price, to sell homes. I don’t accept this logic and firmly believe that Leadhome can offer sellers and buyers alike a far superior alternative to selling homes while putting on average R40,000 per transaction cash back into their pockets. In fact, the single most important factor driving up commissions in South Africa is firstly, property takes longer to sell in South Africa than in other countries, and secondly, only around 35% to 50% of properties that an agent takes to market may sell. Due to these longer sale time frames and the increased risk of not achieving a sale, supply and demand then dictate that a fair price is higher than in countries where properties sell faster and more successfully. I firmly believe that South African homeowners pay exorbitant fees when they use a traditional estate agency to transact and the property market has and continues to recalibrate as a result of Leadhome’s disruptive, market-leading low fixed fee value model.

Affordability

Back to affordability. In an interest rate upcycle economics dictate that home loans become more expensive, impacting buyers and sellers alike. Buyer affordability is affected when purchasing a home, applying for a home loan and affording repayments. Conversely, with fewer buyers in the market, sellers too are affected as with fewer buyers property prices are under pressure.

So buyers can no longer afford to get as much bang for their buck as they could previously. Let’s unpack this:

- In 2020 a 20-year home loan of R1.5 million at a 7% prime rate equated to a monthly bond repayment of R11,629.

- At 9%, this monthly repayment increased to R13,496 an amount of R1,867 extra per month.

- At the current rate of 9.75%, the monthly repayment increases to R14,227 an amount of R2,598 extra per month.

- At 10% the monthly repayment will escalate further to R14,475, R2,846 more each month than the initial repayment enjoyed in July 2020.

Assuming that a buyer can afford to pay a repayment of R11,629 per month on a 20-year bond. At a 7% prime rate, this amount would have been sufficient to purchase a property to the value of R1,5 million.

However, at a 9.75% interest rate, the same R11,629 monthly repayment that a buyer can afford will be sufficient to purchase a home to a lesser value of R1,226,019.

And at 10% affordability is again reduced to a property value of R1,205,050. That’s R300,000 less affordable than the R1.5 million property was at a prime rate of 7% in July 2020.

Why a low fixed fee?

As stated earlier I believe that traditional agencies charge exorbitantly high commissions. Leadhome Properties’ value proposition is unique as instead, we offer the single most competitive fee in the market without cutting corners. A proptech company, Leadhome aggressively incentivises our people, attracting top-performing talent and results-driven agents. In return, our agents earn 70% of the fee, with Leadhome retaining 30% for marketing, brand awareness, best-in-class agent support structures, world-class technology, in-house training and performance coaching.

The best time to enter the market is now

I am often asked the question when is the best time to sell? Now. And the best time to buy? Now. The best months of the year to sell or buy a home are from September to January, as with the arrival of spring and warm summer weather, the market is at its most buoyant.

As a brand, Leadhome inspires our clients to learn to accept less. Less fees, less drama. More cashback in your pocket. More service. A superior property journey, end-to-end. Much more happy.

They learn to accept that with Leadhome, less really is more.

About Leadhome Properties

SA’s No. 1 low-fixed-fee agency, Leadhome Properties uses innovative technology and real-time insights to make selling and buying homes easier, faster and better. A pioneer in challenging the status quo in residential property transactions, Leadhome Properties are agents of change, providing transparency and certainty to clients by using live data to understand the actual market response to properties.

Our trusted, professional agents, provide clients with flexible price offerings (a Low Fixed Fee or Hosted Viewing package), as well as personal, superior advice and tech-enabled, user-friendly services. Leadhome’s proprietary technology and processes enable agents to sell more properties and service our clients better. For more information, visit leadhome.co.za, email: hello@leadhome.co.za, follow us on Facebook, or call us on +27 (0)10 590 3088.